上 in absence of partnership deed profit sharing ratio will be 276031-In absence of partnership deed profit sharing ratio will be

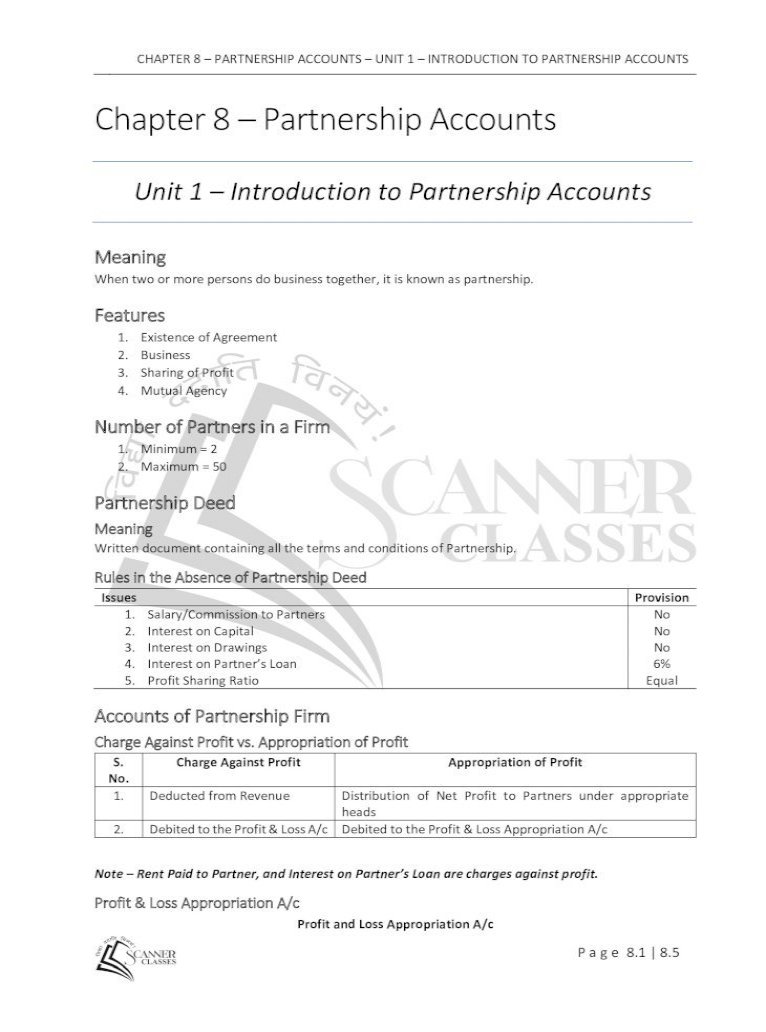

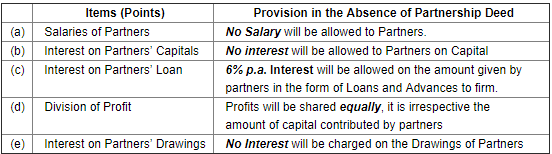

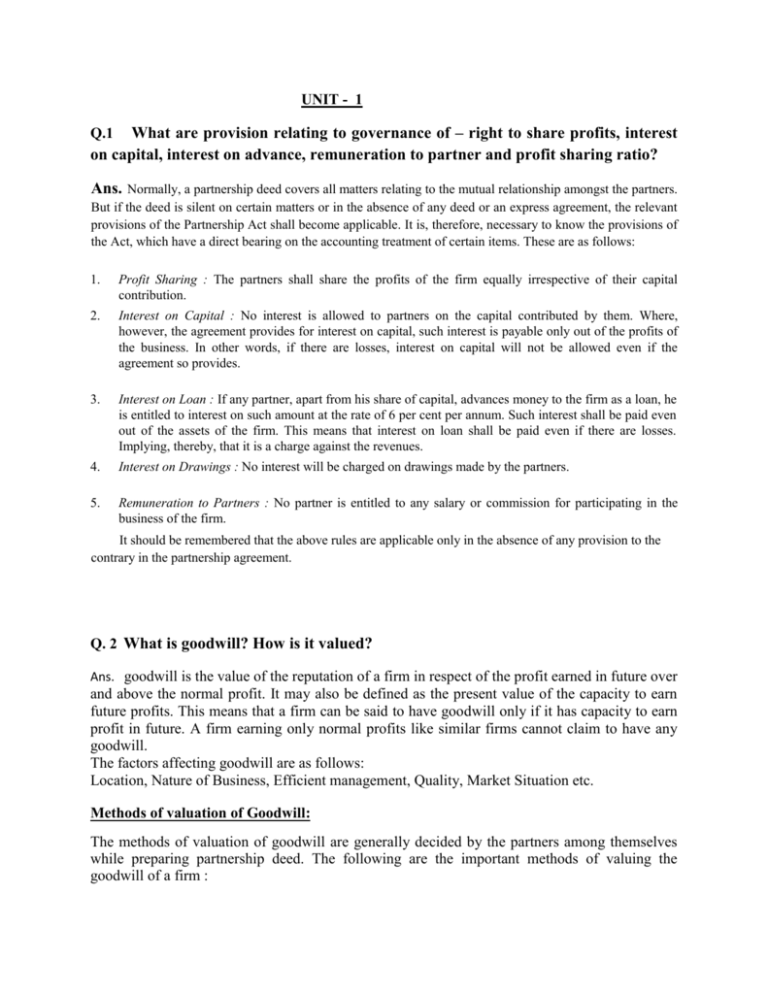

They admit Satish into the partnership with \(\frac { 1 }{ 5 }\) th share Calculate the new profit sharing ratio of all the partners Answer Total share of the firm = 1 Satish's share \(\frac { 1 }{ 5 }\) Remaining Share = \(1\frac{1}{5}=\frac{4}{5}\) New profit sharing ratio of the partners Ramesh \(\frac{4}{5} \times \frac{3}{5}=\frac{12}{25}\) The partnership deed provided that interest on capital shall be allowed at 9% per annum During the year the firm earned a profit of Rs 7,800 Showing your calculations clearly, prepare 'Profit and Loss Appropriation Account' of Jay and Vijay for the year ended The following are the main provisions of the Indian partnership Act, 1932 that are relevant to the partnership accounts in absence of partnership deed 1 Profit Sharing Ratio If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to

Pooling Resources Students Acca Global Acca Global

In absence of partnership deed profit sharing ratio will be

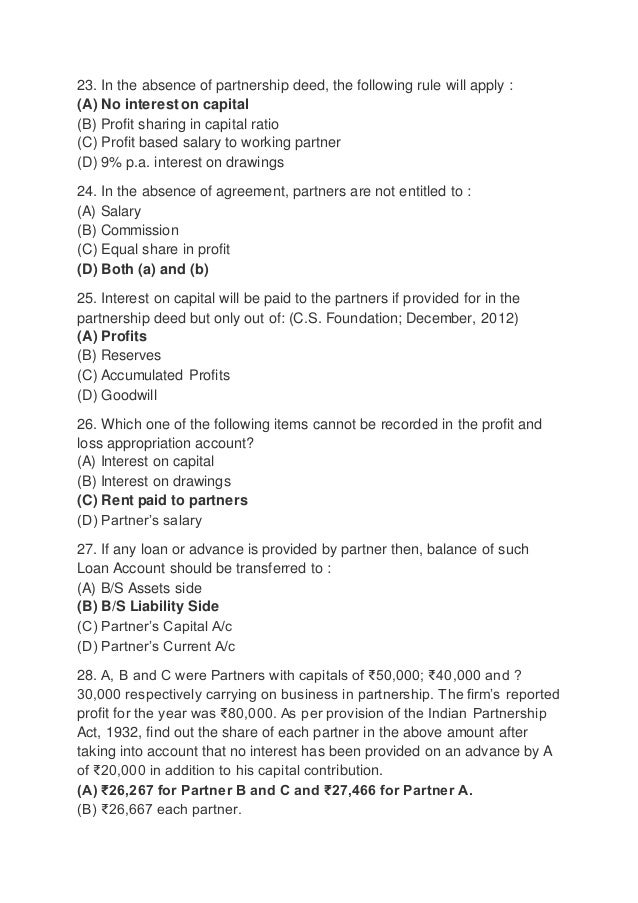

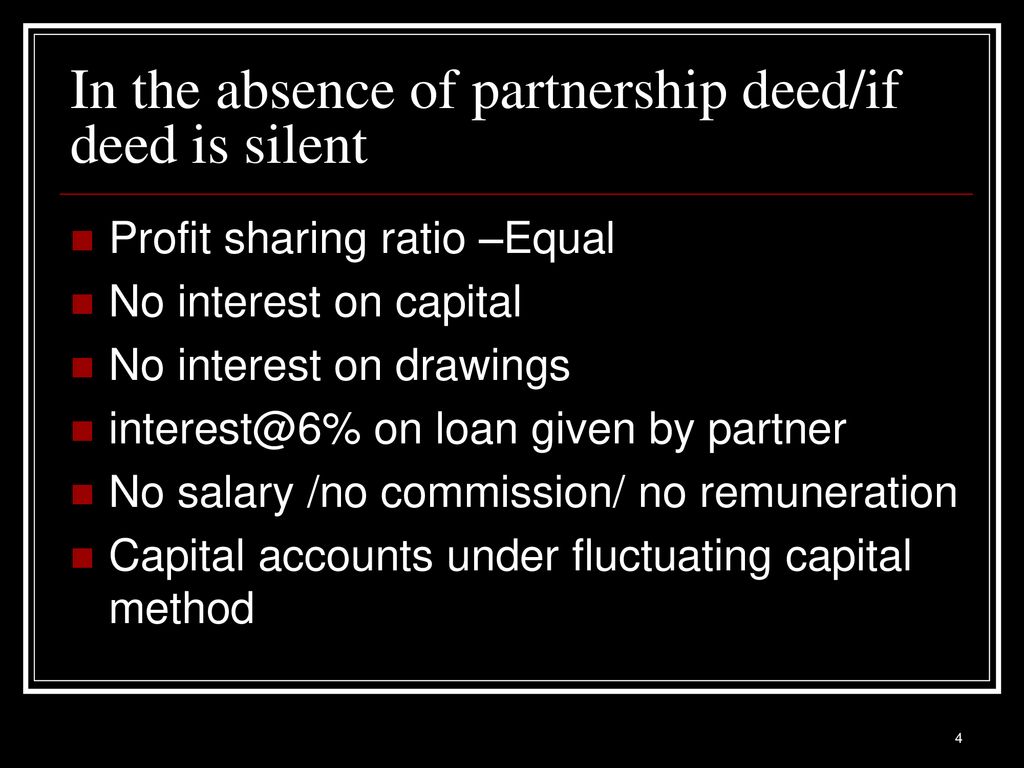

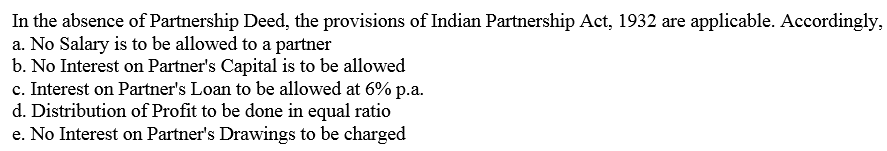

In absence of partnership deed profit sharing ratio will be- Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partners 2In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings 24 In the absence of agreement, partners are not entitled to (A) Salary (B) Commission Equal share in profit (D) Both (a) and (b) 25

What Is A Partnership Deed Clauses It Usually Contains

Answer (b) Old profit sharing ratio 12 Goodwill bought in by an incoming partner in cash to join a partnership firm is share by the old partner in their (a) New profit sharing ratio (b) Old profit sharing ratio (c) Capital ratio (d) Sacrificing ratio Answer (d) Sacrificing ratio 13 If partnership deed silent, interest allowed on partner In the absence of any agreement regarding profit sharing ratio, profit or loss must be shared equally True 18 Interest on capital is a charge against profits False 19 Interest on capital, partner's salaries and partner's commission is an appropriation of profit In the absence of partnership deed, no interest is charged onThe following are the main provisions of the Indian partnership Act, 1932 that are relevant to the partnership accounts in absence of partnership deed 1Profit Sharing Ratio If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be

One way to share profit and losses in the absence of a limited partnership agreement is to divide them by the responsibility carried out by each member The amount of responsibility a partner has is usually known by the partners when the partnership is formed For example, Partner A and Partner B form a partnership The profitsharing ratio of the partners has been specified as 2/3rd ( Sh Rajiv K Luthra) and 1/3 r d ( Sh Mohit Saraf) The assessee accordingly paid total remuneration of Rs 45,00,000/in the profitsharing ratio to both the partners In our view, the clause of the partnership deed satisfies the requirement of the CBDT circular (supra) and there is no violation 17 January 12 Dear sir wheather it possible to change partnership deed regarding profit sharing ratio and amount of salary

It is only done if there is agreement between the partners in the partnership deed What are the Golden Rules ofA and B are trading in partnership sharing profits and losses in the ratio of 3 1 As from 1st January 05, it was decided to change the profit sharing ratio to 3 2 Goodwill will be valued at two years' purchase of the average of three years' profits The profits for 02 Rs 15,000;In the absence of partnership deed, following rules will be applied for governing the partnership (1) Profit sharing ratio will be equal among all partners (2) No interest will be given on partners capitals (3) No interest will be charged on partners drawings

Provisions Of Partnership Deed Indian Partnership Act 1932

Fundamentals Of Partnership Mcq With Answer

Change in profit sharing ratio among partners – A partnership firm has a decided and fixed ratio of profit sharing If the partners with mutual consent decide to change the profit sharing ratio of the firm then it will amount to reconstitution of the firm A new partnership deed will be formed with a new profit sharing ratio and the previous Question A and B are partner's sharing profit in the ratio 21 on 31st March 19, firm's net profit is Rs 86,000 the partnership deed provided interest on capital A and B Rs 5,000 to Rs 7,000 respectively and Interest on drawing from charged A Rs 1,000 per month Calculate profit to be transferred to Partner's Capital A/c What is the Profit sharing ratio in absence of partnership deed?

Accounting Finance For Bankers Jaiib Module D Ppt Download

Question 4 Chapter 2 Of 2 A T S Grewal 12 Class Part A Vol 1

In the absence of a partnership deed and where there is no indication as to the agreement between the partners in this aspect, it should be considered as equal share for all partners The ratio may be specified in terms of absolute values or it may be expressed as the ratio of their Capital account balances or it may be based on anything else as agreed upon by the partners In the absence of partnership deed, profit sharing ratio is (a) in capital ratio (b) equally asked in General Introduction of Partnership by Umesh01 ( 658k points) general introduction of partnership In the absence of a partnership deed, the terms of the 1932 Partnership Act referred above would apply— (1) Gains and losses are be equally divided (2)

Class 12 Accounts Fundamental Of Accounts Notes

Freehomedelivery Net

The following are the provisions that are relevant to the partnership accounts in absence of partnership deed (i) Profit Sharing Ratio When a partnership deed is not made or even if it is made and silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act 1932, profits and losses are to be shared 23 In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings Answer Answer AWN 2 Calculation of Profit Share of each Partner In the absence of partnership deed, profits of a firm are distributed equally among all the partners Pofit of A Page No 280 Question 7 A and B are partners in a firm sharing profits in the ratio of 3 2 They had advanced to the firm a sum of ` 30,000 as a loan in their profitsharing

Chapter 8 A Partnership Accounts A Unit 1 A Introduction Chapter 8 A Partnership Accounts Unit Pdf Document

Class 12 Accounts Fundamental Of Accounts Notes

Profit will be distributed in Equal ratio When there is no partnership deed or partnership deed is prepared but it is silent on profit sharing ratio, in such a case rules of Partnership Act, 1932 will be applicable According to which, profits or losses will be shared by the partners equally irrespective of their capitalsIn the absence of partnership deed, each partner gets equal share in profit, no matter how much contribution made by him including sleeping partner Answer 12 – b) Equal share in profit Explanation 13In the absence of partnership deed, interest @6% pa is to be allowed on loans and advances of partners Answer 13 – b) Interest on loan @6% a In the absence of partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, the following provisions of the Indian Partnership Act, 1932 will be applicable PROFIT SHARING RATIO Profits and losses are to be shared equally irrespective of their capital contribution

Startup Partnership Deed

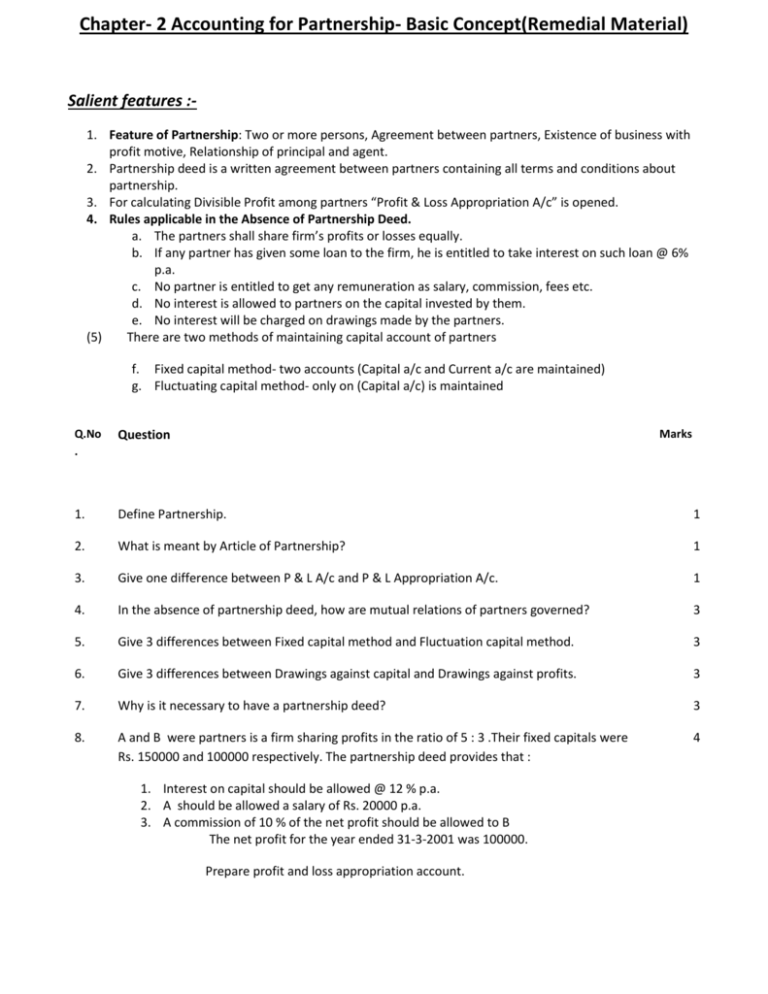

Doc Chapter 2 Accounting For Partnership Basic Concept Remedial Material Kelvin John Ramos Academia Edu

A firm can be reconstituted at the time of change in profit sharing ratio among existing partners, admission, retirement or death of a partner and amalgamation PSR should be divided equally in the absence of partnership deed or any other agreement regarding sharing of profit and lossesAnswer (i) Sharing of Profit and Losses In the absence of partnership deed profit the sharing ratio among the pad maw will be equal (ii) Interest on Partner's Capital In the absence of panama peru interest on partners capital will not be givenZIn the Absence of the Partnership Deed The partnership deed lays down the terms and conditions of partnership in regard to rights, duties and obligations of the partners In the absence of partnership deed, there may arise a controversy on certain issues like profit sharing ratio, interest on capital, interest on drawings,

Reema And Seema Are Partners Sharing Profits Equally The Partnership Deed Provides That Both Sarthaks Econnect Largest Online Education Community

Page 17 Ma 12

6 In the absence of partnership deed partner share profit and loss in a Ratio of capital Employed b Equal Ratio c 2 1 d 1 2 7 As per section a minor may be admitted for the benefit of the partnership ifa One partner agree b More than one agree cA) Profit Sharing Ratio b) Interest on Capital c) Interest on Drawing d) Interest on advances from partners e) Remuneration to partners for firm's workIn the absence of partnership deed the profit and loss arising from the partnership business is shared equally by the partners It is not shared according to capital contributed by the partners;

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 21

Active Partner

Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partnersHence, it is always best course to have a written partnership deed duly signed by all the partners and registered under the Act Rules applicable in the absence of partnership deed Profit sharing Ratio Equal, irrespective of capital contribution No Interest on Their new profit sharing ratio will be 2 1 1 1 Calculate the value of goodwill of the firm, showing your workings clearly Pass necessary journal entries for

Kendriya Vidyalaya Sangathan Partnership Deed Is A Written Agreement Among The Partners Which Contains The Terms Of Following Circumstances A Partnership Firm May Be Reconstituted

Provisions Of Partnership Deed Indian Partnership Act 1932

In case of absence of a partnership deed the profit will be shared among the partners equally According to partnership act 1932, in the absence of any partnership deed, profits of the firm are divided among the partners equally03 Rs ,000 and 04 Rs 25,000 Share Shradha Kumari Provision of partnership act 1932 Rules applicable in the absence of partnership deed which will be relevant for accounting such as , no interest is allowed to partners on capital, no interest will be charged on drawings made by partners so same rule is applicable in the absence of partnership deed that is the profit and losses will

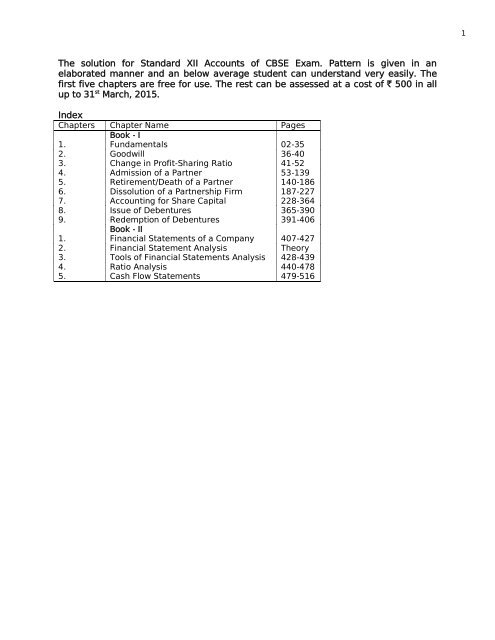

1

Partnership Deed Meaning Format Registration Stamp Duty

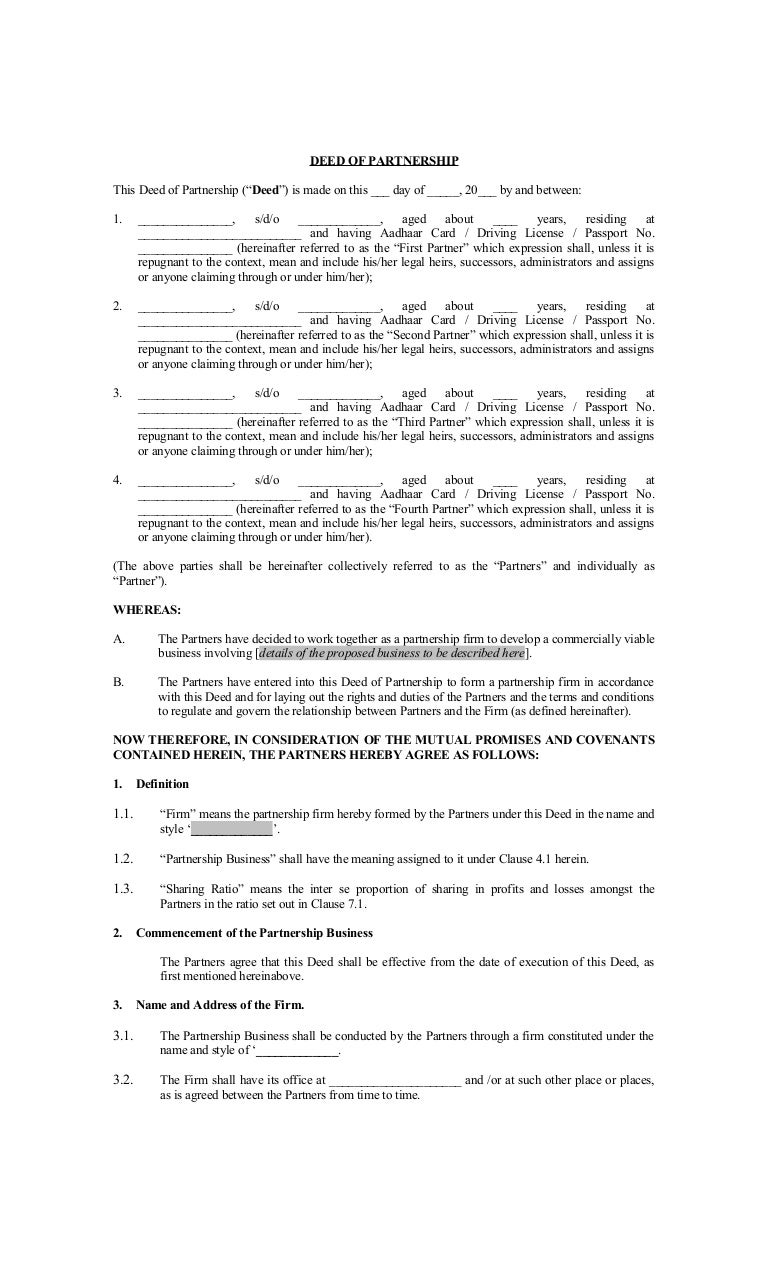

Partnership deed is the main document of Partnership firm which contains details such as Capital Contributions of Partners, Profit Sharing Ratio, Terms & Conditions of Partnership Firm, Interest on Capital & Drawings It is the legal document & mandatory to maintain by Partnership Firm All Partner's Signatures are required on Partnership If there is no partnership deed, the profit should be distributed, As per capital ratio Anyway, if all partners hasn't shared the effort equally, then the effort put on business also should consider with investment Without partnership deed, profit will be shared equally between partners In the absence of partnership deed, profit sharing ratio is (a) in capital ratio (b) equally (c) sacrificing ratio (d) as decided by the partners Answer (b) Question 3 Calculate the interest on Ram's drawings @ 10% if he withdrawn Rs 24,000 during the year

In The Absence Of Any Agreement Interest On Advances By A Partner Is

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Profit Sharing Ratio In the absence of partnership deed all partners will share Profit or losses in equal ratio Interest on Capital No interest will be given to any partner on his capital In case, there is a partnership deed, which allows interest on capital, it will be allowed in case of profit but not in case of loss in the business3 Salary/ Commission to partner No partner is entitled to salary/ commission from the firm, unless the partnership deed provides for it 4 Interest on loan If any partner, apart from his share capital, advances money to the firm as loan, he is entitled to interest on such amount at the rate of six percent per annum 5 Profit sharing ratio The partners shall share the profits of theGeneral rule for liabilities is borne equally by all partners unless an agreement contrary to it exists between all partners In absence of partnership deed the scope of anything else but equal shared gains and liabilities will followed in the bus

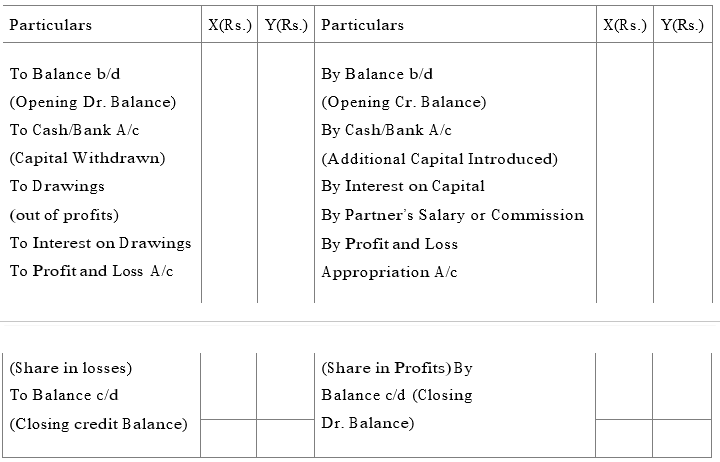

Accountancy Practical Oriented Questions Section D 1 Prepare Opening Statement Of Affairs With 5 Imaginary Figures 2 Prepare Capital Accounts Of Two Partners Under Fluctuating Capital System With 5 Imaginary Figures 3

In The Absence Of An Agreement To The Contrary Partners Share Profits And Losses In

In the absence of partnership deed, profit sharing ratio is (a) in capital ratio (b) equally asked in General Introduction of Partnership by Umesh01 ( 658k points) general introduction of partnership Prepare Receipts and Payments Account of a Not – For – Profit Organization with 5 imaginary figures How do you treat the followings in the absence of Partnership Deed?Q7 A and B are partners in a firm sharing profits in the ratio of 3 2 They had advanced to the firm a sum of ₹ 30,000 as a loan in their profitsharing ratio on 1st October, 17 The Partnership Deed is silent on interest on loans from partners

Department Of Accounting And Finance Course Code Acc Ppt Download

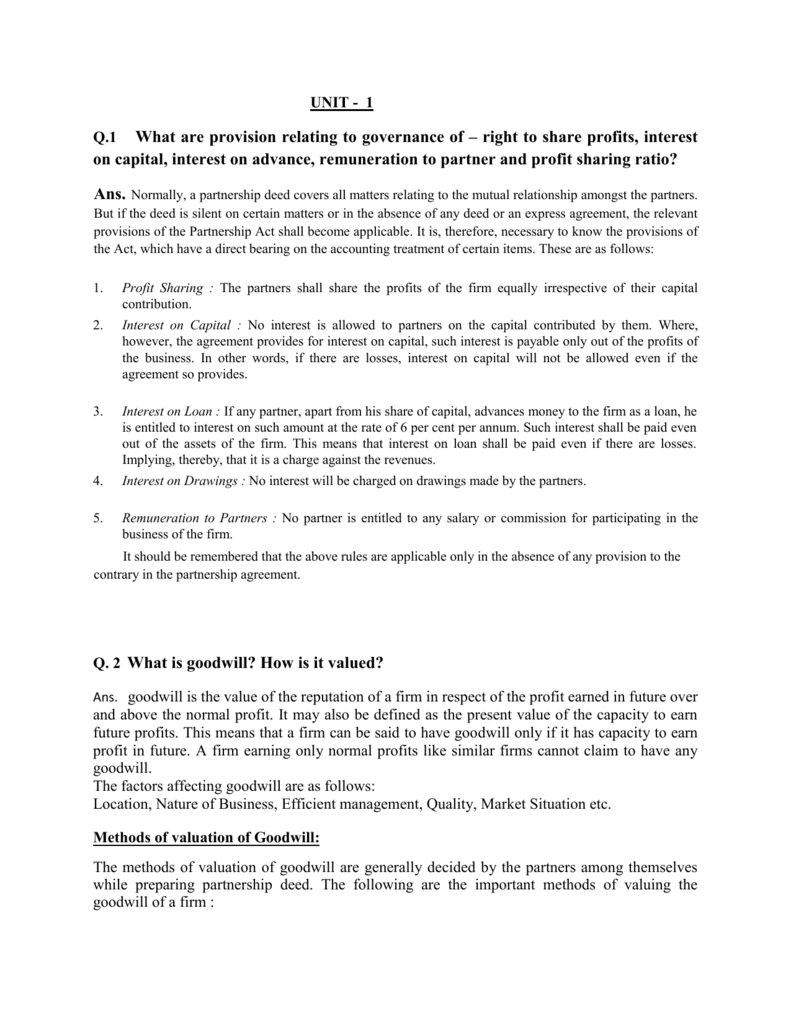

Q 1 What Are Provision Relating To Governance Of Right To Share

a) Profit Sharing Ratio In the absence of partnership deed all partners will share Profit or losses in equal ratio b) Interest on Capital No interest will be given to any partner on his capital in the absence of partnership deed In case, there is a partnership deed, which allows interest on capital, it will be allowed in case of profit but A, B and C shared the profit of Rs 9,00,000 in the ratio of 2 2 1 without providing for interest on B's loan, B granted a loan of Rs 4,00,000 in the beginning of accounting year Whereas the partnership deed is silent on the interest on loan and the profit sharing ratioProvisions of Partnership Act, 1932 in the absence of Partnership Deed (a) Profit Sharing Ratio If the partnership deed is silent about the profit sharing ratio, the profits and losses of the firm are to be shared equally by partners (b) Interest on Capital No interest on capital is payable if the partnership deed is silent on the issue

Partnership Deeds Meaning Contents With Solved Questions

2

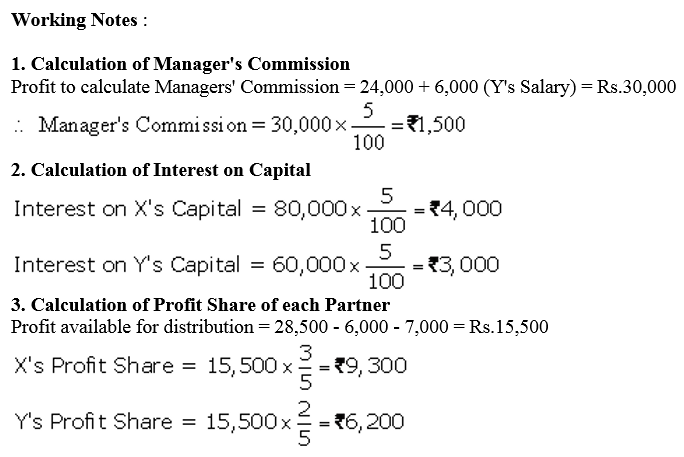

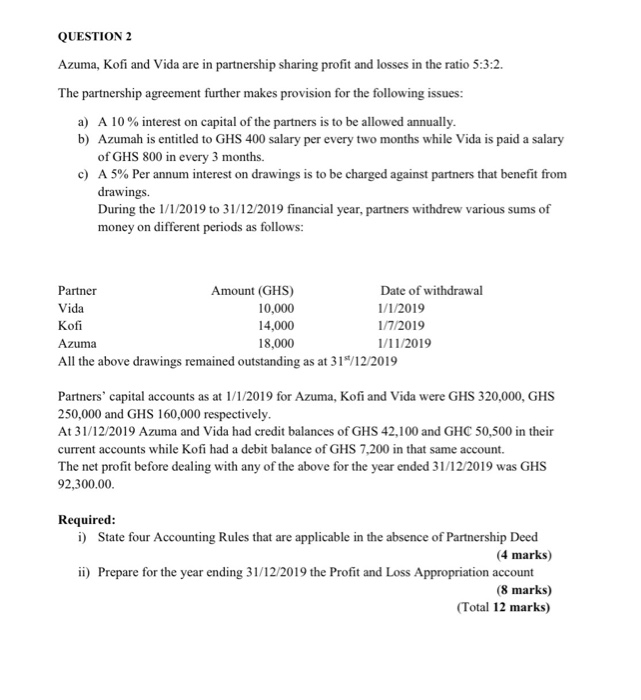

The Partnership deed provided for the following (i) Interest on Capital at 6% (ii) Interest on drawings at 9% Each partner drew Rs 12,000 on 1st July, 04 (iii) Rs 25,000 is to be transferred in a Reserve Account (iv) Profit sharing ratio is 53 2

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts Www Cbs Learn Accounting Accounting Solutions

Unit 1 Accounting For Partnership Firms Marks 35 Dissolution Of A Partnership Firm Types Of Dissolution Pdf Document

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Important Questions For Cbse Class 12 Accountancy Profit And Loss Appropriation Account

Partnership Definition Features Advantages Limitations

Day 5 Class 12th Commerce Rules Applicable In The Absence Of Partnership Deed Youtube

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Partnership Accounts

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

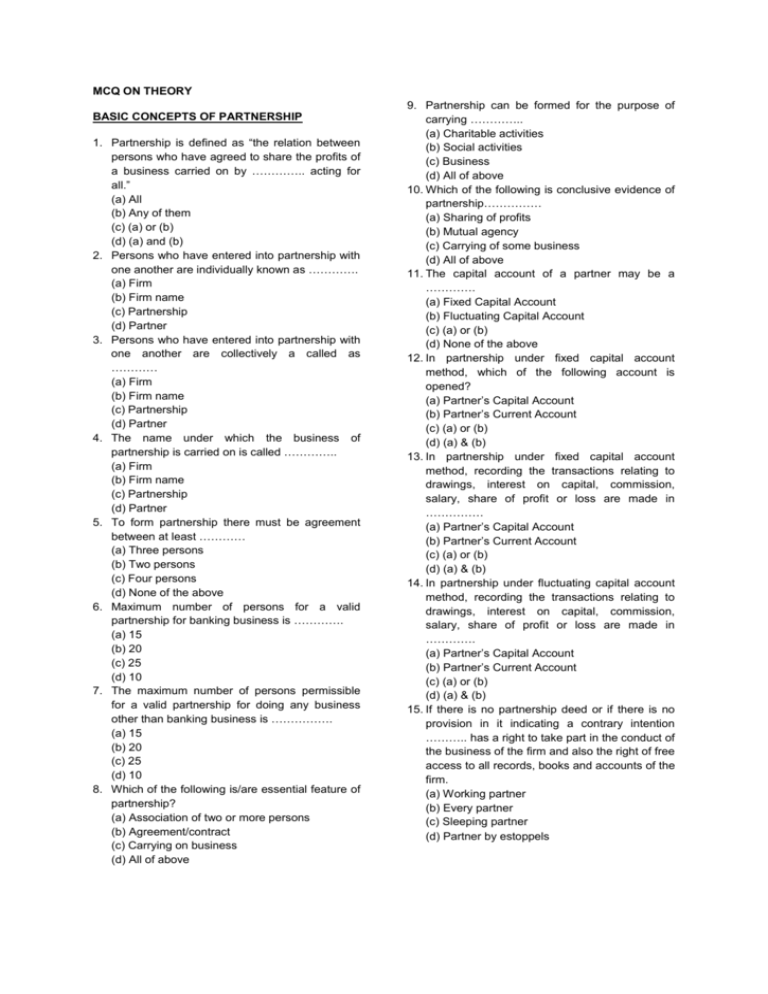

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

In The Absence Of Partnership Deed Youtube

Accounting For Partnership Notes Class 12 Accountancy

Pooling Resources Students Acca Global Acca Global

Page 30 Debk Vol 1

Partnership Acuuutis Tunamentals 1 109 Loan From Partners And Loan To Partners Clay And Joy Are Partners In A Firm Sharing Profits In The Ratio Of 3 2 They Had Advanced To The Firm

Ram Rahim And Roja Are Partners Sharing Profit And Loss In The Ratio Of 3 2 1 As Per Partnership Deed Sarthaks Econnect Largest Online Education Community

Icaeizeqdtndnm

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

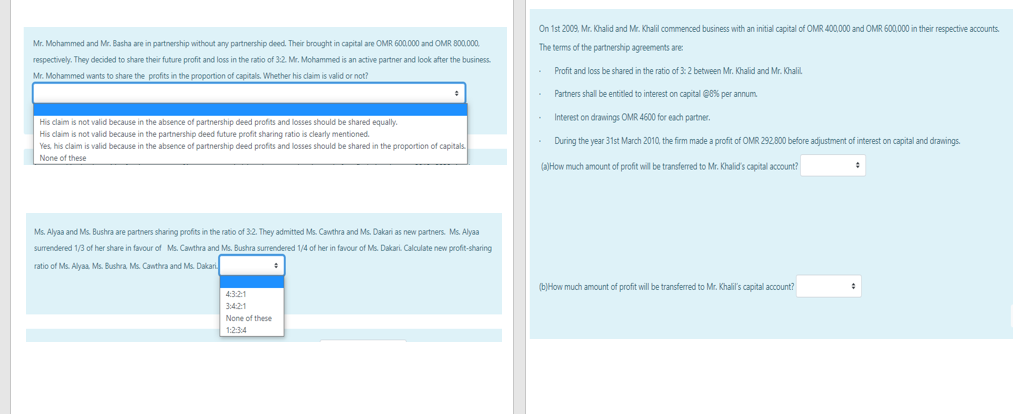

On 1st 09 Mr Khalid And Mr Khalil Commenced Chegg Com

Study Material Notes Partnership Fundamentals Sample Page Accounts Aptitude

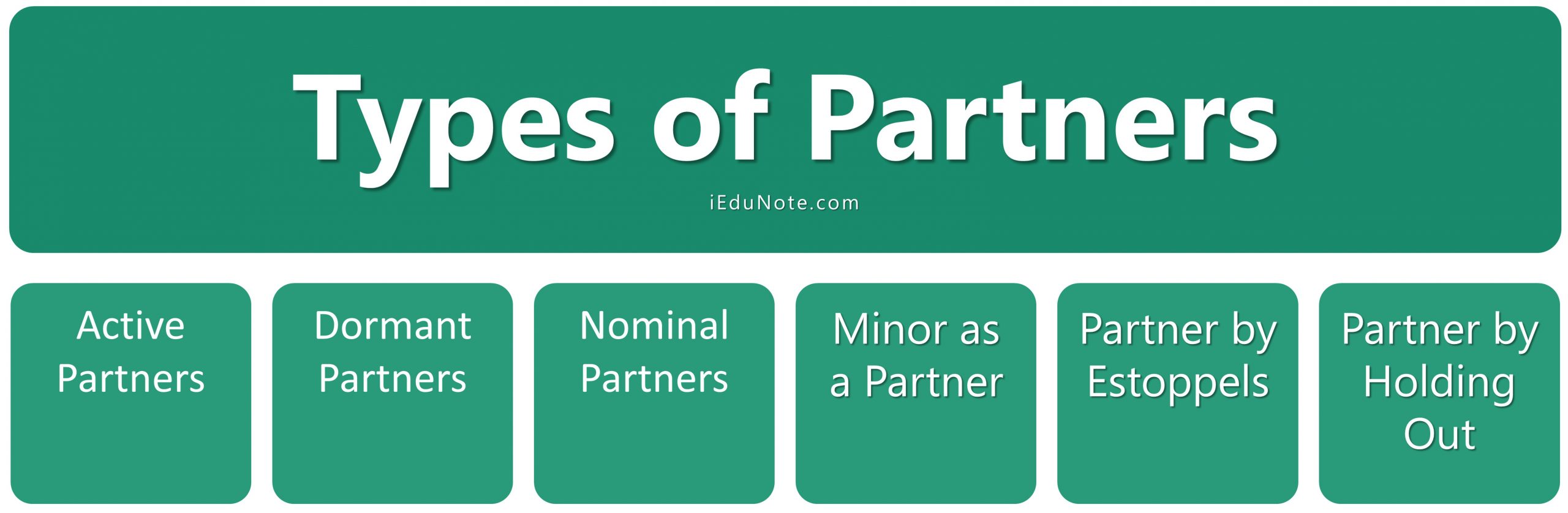

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

12th Accountancycbse Omqs Flip Ebook Pages 1 50 Anyflip Anyflip

Question Bank For Accountancy Class Xii 14 15

Myncert Com

Class 12 Accounts Fundamental Of Accounts Notes

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Class 12 Accounts Fundamental Of Accounts Notes

What Is A Partnership Deed Clauses It Usually Contains

Accounts14

Unit 1 Accounting For Partnership Firms Marks 35 Dissolution Of A Partnership Firm Types Of Dissolution Pdf Document

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals

Cbse Class 12 Partnership Deed Meaning And Importance In Hindi Offered By Unacademy

Solved Paragraph Ram And Shyam Were Partners In A Firm The Partnership Agreement Provides That 1 Profit Sharing Ratio Will Be Quot 3 Il Ra Course Hero

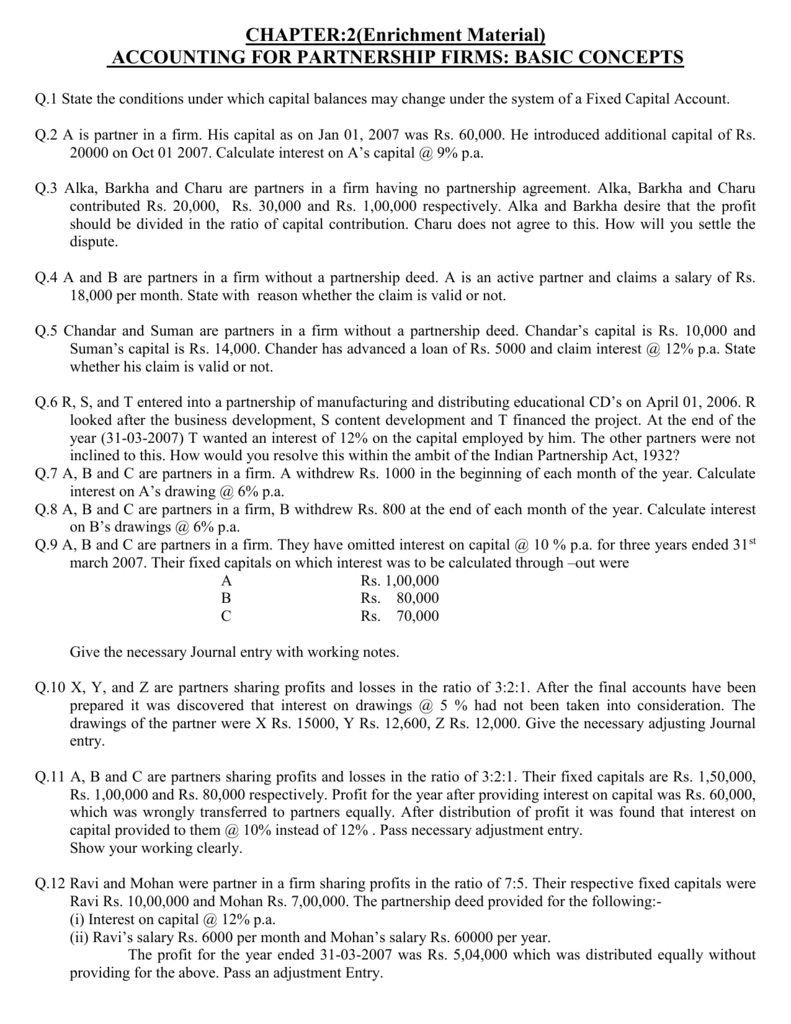

Chapter 2 Accounting For Partnership Firms Basic

1

All You Need To Know About The Indian Partnership Act 1932

Profit Sharing Ratio Fundamentals Of Partnership 2 Partnership Chandan Poddar Youtube

Distribution Of Profits In Given Ratio L Partnership Youtube

12th Accountancycbse Omqs Flip Ebook Pages 1 50 Anyflip Anyflip

Cbse Class 12 Accountancy Accounting For Partnership Firms Fundamentals Notes Concepts For Accountancy Revision Notes

Ramesh Wants To Retire From The Firm The Gain Profit On Revaluation On That Date Was Rs 12 000 Sarthaks Econnect Largest Online Education Community

2jnomj8w4bzlom

Accounts Solutions For Xii Standard Chapters 1 2 3 4 5

Partnership Deed Accounts Class 12 Arinjay Academy

X Y And Z Are Partners In A Firm Sharing Profits In 2 2 1 Ratio The Fixed Capitals Of The Brainly In

In The Absence Of Partnership Deed Profit Sharing Ratio Will Be 1

Accounting Finance For Bankers Final A Cs Of Banks Cos Jaiib Module D Presentation By Ravi Ullal 24 O Ppt Download

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Remuneration To Partners In Partnership Firm Under 40 B

Accounting For Partnership

Experts Pls Answer This Question I Tried My Level Best To Solve This Problem But Unable To Solve It Answer Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Ts Grewal Solution Class 12 Chapter 5 By Studies Today Issuu

Accounting For Partnership Notes Class 12 Accountancy

Partnership Deed Bhardwaj Accounting Academy

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Cbse Class 12 Lesson 2 Applicability Of Provisions In The Absence Of Partnership Deed In Hindi Offered By Unacademy

Profit Loss Appropriation Goodwill Free Video Lecture Tutorials You Tube Questions And Answers Ca Cpt Cs Cma Foundation om Hons Youtube

Class 12 Accounts Fundamental Of Accounts Notes

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

A And B Are Partners In A Firm Sharing Profits In The Ratio Of 3 2 They Had Advanced To The Firm A Sum Of Rs 30 000 Sarthaks Econnect Largest Online Education Community

Partnership Fundamentals Objective Type Mission Accountancy

Gv Commerce Classes Posts Facebook

16 Pavan Prince And Roy Were Partners In A Firm Sharing Profits In 2 2 1

In A Partnership Firm One Of The Partner X Had No Capital Account What Could Be The Reason

Partnership Deed By Dhanya V L

Ncert Solutions For Class 12 Accountancy Chapter 4 Reconstitution Of A Partnership Firm Retirement Death Of A Partner

Class 12 Accounts Fundamental Of Accounts Notes

1

Unit 1 Accounting For Partnership Firms Marks 35 Dissolution Of A Partnership Firm Types Of Dissolution Pdf Document

Partnership Accounting Multiple Choice Questions And Answers Pdf Jobsjaano Com

Mention Any Four Provisions Of The Partnership Act In The Absence Of Partnership Deed Business Studies Nature And Significance Of Management Meritnation Com

What Is Partnership Definition Characteristics And Types Business Jargons

Question 2 Azuma Kofi And Vida Are In Partnership Chegg Com

क न द र य व द य लय स गठन Pdf Free Download

Q 1 What Are Provision Relating To Governance Of Right To Share

Rohan Acs Ppt 1

コメント

コメントを投稿